nebraska sales tax rate

The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. The Ord Sales Tax.

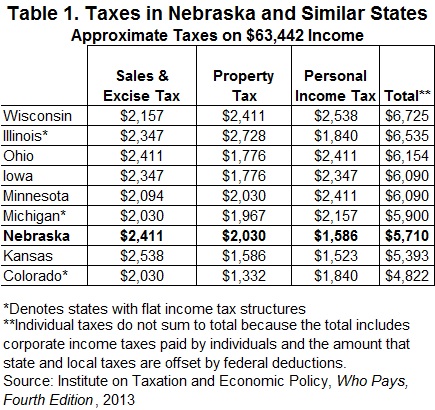

Taxes And Spending In Nebraska

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

. Sales Tax Rate Finder. Average Sales Tax With Local. Nebraska state sales tax.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Nebraska levies a property tax on all real and personal property within the state. Exemptions from sales tax in Nebraska include groceries prescription medications and most medical equipment.

Integrate Vertex seamlessly to the systems you already use. There is 0 additional tax districts that. For vehicles that are being rented or leased see see taxation of leases and rentals.

This is the total of state county and city sales tax rates. Bloomberg Tax Expert Analysis Your Comprehensive Nebraska Tax Information Resource. Nebraska sales tax details.

In addition to taxes car. The use tax rate is the same as the sales tax rate. Sales tax region name.

Nebraska has recent rate changes Thu Jul 01. Waste Reduction and Recycling Fee. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. 30 rows The state sales tax rate in Nebraska is 5500. When calculating Nebraskas sales and use tax determine the taxes the local jurisdiction charges for the city and county then add those percentages to the state sales tax percentage of 55.

Sales and Use Taxes. Tax rates last updated in August 2022. ArcGIS Web Application - Nebraska.

NE Sales Tax Calculator. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Businesses are responsible for paying.

See the County Sales and Use Tax Rates section at the. The Nebraska NE state sales tax rate is currently 55. Ad Be the First to Know when Nebraska Tax Developments Impact Your Business or Clients.

While many other states allow counties and other localities to collect a local option sales tax. 536 rows Nebraska Sales Tax55. This is the total of state county and city sales tax rates.

FilePay Your Return. Printable PDF Nebraska Sales Tax Datasheet. With local taxes the total sales tax rate is between 5500 and 8000.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Groceries are exempt from the Nebraska sales tax. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. What is the sales tax rate in Nemaha Nebraska.

Nebraska Sales Tax Rate The sales tax rate in. What is the sales tax rate in Omaha Nebraska. The minimum combined 2022 sales tax rate for Nemaha Nebraska is.

Municipal governments in Nebraska. Counties and cities can charge an. The Nebraska state sales and use tax rate is 55 055.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

General Fund Receipts Nebraska Department Of Revenue

Taxes And Spending In Nebraska

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

State Income Tax Rates Highest Lowest 2021 Changes

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Taxes And Spending In Nebraska

Nebraska Sales Tax Small Business Guide Truic

Nebraska Sales Tax Handbook 2022

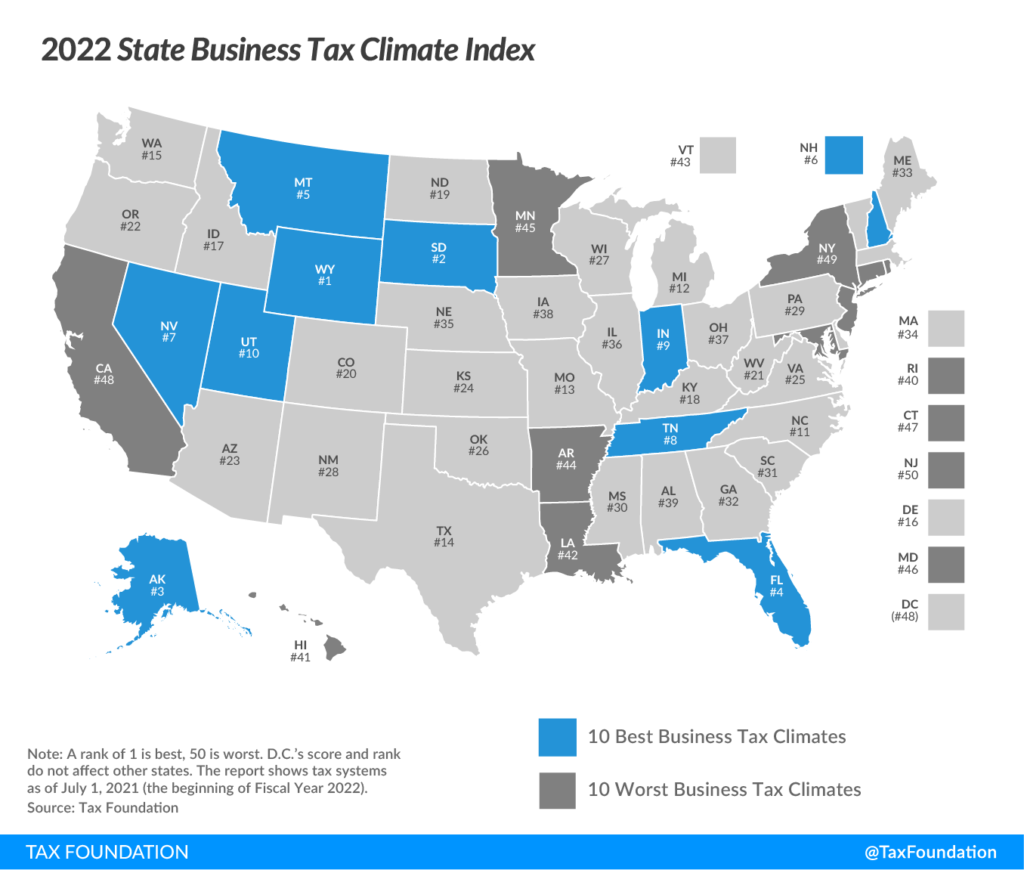

Nebraska Drops To 35th In National Tax Ranking

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

Sales Tax By State Is Saas Taxable Taxjar

Wfr Nebraska State Fixes 2022 Resourcing Edge

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation